1. INTRODUCTION

A Guarantee is legally defined as an undertaking to answer for the payment or performance of another person's debt or obligation in the event of a default by the person primarily responsible for it.

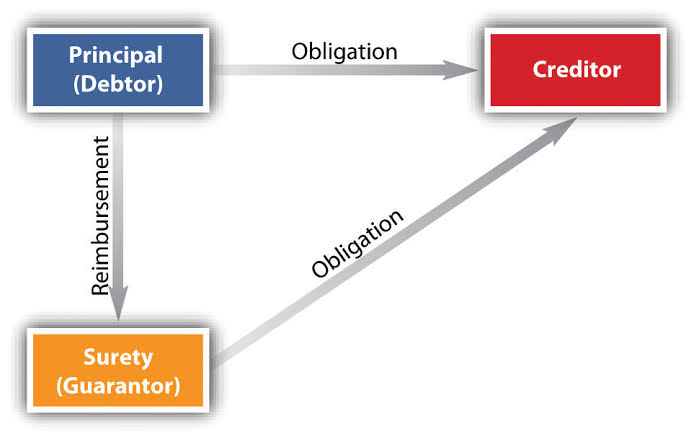

In Tanzania a contract of Guarantee is defined by the Law of Contract Act, Cap.345 (LCA) as a contract to perform the promise, or discharge the liability, of a third person in case of his default and the person who gives the guarantee is called the "surety"; the person in respect of whose default the guarantee is given is called the "principal debtor", and the person to whom the guarantee is given is called the "creditor"; and guarantee may be either oral or written.

Over the years the business community in Tanzania has been dependent on loans or credit facilities as a way of boosting capital to increase profitability. Borrowing in the formal sector involves dealing with regulated lending entities and this has become a challenge to small and medium size businesses because it requires adherence to various lending policies and regulations which are provided by the Central Bank of Tanzania. This is reason lenders require guarantors to stand as their sureties to secure the debt.

2. INGREDIENTS OF A CONTRACT OF GUARANTEE

Generally, in a contract of Guarantee, three parties are formed; i.e. Creditor, Borrower (Debtor) and Guarantor (Surety). In this type of contract the Creditor has legal rights over the remaining parties in the contract with exception. Whether you are a Creditor, Principal Debtor or Guarantor there are very important things to consider when engaging in a contract of guarantee. The main components or ingredients of a contract of guarantee are as expressed below;

Parties to a contact of Guarantee include; (i) Creditor who is a person to whom the guarantee is given. (ii) Principal debtor (Borrower) is a person in respect of whose default the guarantee is given. (iii) Surety (Guarantor) who is a promisor in the event of default by the principal debtor.

An offer must be made by surety (guarantor) to the Creditor. Acceptance of the offer may be express or implied but usually it is done by implication when the loan is issued.

Consent in any contract is important, in this type of contract nothing is new as the ingredients are the same as provided in Section 19, 20, 94 and 95 of the Law of Contract Act. If the consent is obtained under duress or by mistake or under influence, the contract becomes void.

The law strictly provides that Capacity is essential in a contract for guarantee just like any other contract. Only adults are presumed be good in contracts as they know how to make a good decision. Minors cannot enter into a contract of guarantee; Creditors can enter into a contract with minor at their own cost with no legal advantage or force.

5. Consideration

Anything done or any promise made for the benefit of the Principal Debtor may be sufficient consideration to the surety (guarantor) for giving the guarantee.

3. TYPES OF CONTRACT OF GUARANTEE

Contract of guarantee may be oral or written however, the common law practice made it preferable that the contract of guarantee should be in written form.

4. TYPES OF GUARANTEE

5. SURETY’S LIABILITY

We have to note that the liability of the guarantor (surety) is co-extensive with that of the principal debtor unless it is otherwise provided by the contract. The liability has to be strictly limited to what parties have contractually agreed. If parties agreed to a contract of guarantee amounting to Tshs. 30,000,000 (Thirty Million Shillings) the liability to the guarantor shall be the same Thirty Million Shillings. If the Principal Debtor advanced the sum of Tshs. 40,000,000 (Forty Million Shillings), the guarantor will only be liable to pay the same 30 Million shillings because it is what parties agreed as a guarantee.

It is important to note that the obligation of surety (guarantor) starts once Principal Debtor defaults, see CRDB BANK LIMITED v ISSACK B. MWAMASIKA and two others Civil Appeal No. 139 of 2017. Creditors are supposed to consult the Principal Debtor first so that the Principal Debtor liquidates his debt before the guarantor takes responsibility for his/her guarantee. The law further provides that, any variance, made without the guarantors consent in the terms of the contract between the principal debtor and the creditor, discharges the guarantor as to transactions subsequent to the variance. When an individual signs a contract of guarantee and he/she happens to be unaware of the rights and obligations provided by the terms of the contract and by the law governing such dealings, this individual is puts himself/herself in risky position as far as the transaction is concerned.

6. RIGHTS OF SURETY (GUARANTOR)

The law provides for a right to be indemnified by Principal Debtor and right to recover from Principal Debtor whatever sum he has rightfully paid under the guarantee but not sum paid wrongfully.

The law gives sureties the rights which the creditors have against Principal Debtor.

It gives the guarantor rights to benefit from every security the creditor had against the Principal Debtor.

The law further provides the guarantor with the right to contribution from co-guarantors.

7. TERMINATION OF GUARANTEE

The law provides that the guarantor may terminate a contract of guarantee at any time or he may revoke a continuing guarantee by notice to the creditor.

The death of the surety operates, in the absence of any contract to the contrary, as a revocation of a continuing guarantee, so far as regards future transactions.

Variation made without surety’s consent in the terms of the contract between the Principal Debtor and the creditor discharges the surety as to transactions subsequent to the variance.

The surety is discharged by any contract between the creditor and the principal debtor by which the principal debtor is released or by any act or omission of the creditor, the legal consequence of which is the discharge of the principal debtor.

The surety is discharged by any contract between the creditor and the principal debtor, by which the principal debtor is released, or by any act or omission of the creditor, the legal consequence of which is the discharge of the principal debtor.

A contract between creditor and the principal debtor by which the creditor makes a composition or promise to give time to or not to sue the PD, discharges the surety unless the surety assents to such contract.

8. CONCLUSION

When trying to secure a loan most businessmen tend do whatever it takes to ensure they get the facility and sometimes they do not understand the types of contracts they enter into and their future implications. In this article we are trying to create a little awareness and understanding of how a contract of guarantee works to our readers.

DISCLAIMER: This article has been prepared for general information on matters of interest to our clients and any other readers. It does not constitute legal opinion or professional advice in any way. We are ready to provide specific technical advice to anyone who contacts the firm directly for any enquiries. You should not act upon the information contained in this article without obtaining specific professional advice and guidance from a legal practitioner. No representation or warrant (express or implied) is given to the accuracy or completeness of the information contained in this article. HECON ASSOCIATES does not accept or assume any liability, responsibility or duty of care for any consequences or inconvenience for any consequences of you or anyone else acting or refraining to act, in reliance on the information contained in this article or any decision based on it.